Corporations 7 percent of net income. Statutory corporate income tax rate.

Calculate Child Support Payments Child Support Calculator The Answer Is Yes Child Support Quotes Child Support Quotes Child Support Payments Child Support

IIT prior year rates.

. Effective July 1 2017. Income for which you received a W-2which would mean you are an employeecannot be calculated as self-employment income. Employees receive statutory holiday pay if they.

495 percent of net income. Some people think employees only need to work the day before and the day after to qualify for statutory holiday pay. So we can still use the case law relating to Section 19 ICTA 1988 and its statutory predecessors to help us decide if a particular payment is or is not earnings within Section 622 ITEPA 2003.

Have worked or earned wages like paid vacation days or another statutory holiday on 15 of the 30 days before a statutory holiday. From employees fair treatment of labor to protecting the company from unreasonable wage or benefit demands from trade unions or aggressive employees every company faces a worrying number of potential legal issues relating to compliance. Targeted statutory corporate income tax rate.

The same goes for income received from an activity that fits the narrow IRS definition of a hobby. You can apply for new style Employment and Support Allowance. A lot of your organizations time effort and money go into ensuring that payroll is compliant through a statutory audit.

Direct sellers and licensed real estate agents are treated as self-employed for all Federal tax purposes including income and employment taxes if. Government at a Glance - 2011 edition. Nowadays I am more circumspect and tell them.

What Is Not Considered Self-Employment Income. Withholding and Unemployment Contributions 941ME and ME UC-1 Withholding Tables and Annual Reconciliation W-3ME. Protecting and promoting the health and safety of the people of Wisconsin.

Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME. Have been employed for 30 calendar days. It does not.

Direct sellers licensed real estate agents and certain companion sitters. You can apply for new style ESA up to 3 months before your SSP ends. Trusts and estates 495 percent of net income.

Personal Property Replacement Tax. BIT prior year rates. Public sector employment and pay.

Multinational corporations paid less than 10 percent in corporate income taxes on US. However the Court added that regardless of a taxpayers material participation actual or required if the rental income is shown to be less than or equal to fair market rental value the rental income is presumed to be unrelated to any employment agreement or other business arrangement to which the taxpayer is a party. Schedule SE has been changed for the 2020 tax year with the elimination of the short form option and the addition of a new Part III to calculate an optional deferral of part of.

If your Statutory Sick Pay SSP is due to end. The amount you must pay for self-employment tax depends on the profit or loss of your business for the tax year. In 2018 married couples making about 150000 working at their own small business paid over 20 percent of their income in federal income and self-employment taxes.

Top statutory personal income tax rates. There are three categories of statutory nonemployees. Profits 73.

Open and inclusive government. Self-employment tax is based on your business income. Unless your self-employment involves dealing and brokering investment.

For years and some time ago I used to advise that if their self-employed income was below their personal allowance and there was no other income then there was no need to register with HMRC as they had no chargeable income TMA1970 s. Fillable and printable Statutory Declaration Form 2022. Corporations other than S corporations 25 percent of net income.

Hr Auditing Firm Employee Retention Employee Relations Training And Development

Link Aadhaar With Epf Uan Account Online Offline Process Accounting Online Accounting Bank Account

Accountant Resume 2 Accountant Resume Risk Management Resume

Step 3 Your Home Supportive Mortgage Lender

Welfare Spending In The Uk Income Support Welfare Carers Allowance

Sample Compensation Agreement Templates Contract Agreement Contract Template Agreement

Instructions For Form 8995 2019 Internal Revenue Service Small Business Tax Business Tax Federal Income Tax

Tax Calculation Spreadsheet Excel Formula Spreadsheet Spreadsheet Template

Iict Networkingtraining Hardware Iict Is The No 1 Hardware And Networking Training Institute In Chennai Supportive Desktop Support Training Center

Law Student Resume Sample Resumecompanion Com Law School Life Law School Inspiration Law School Prep

Proof Of Employment Form Employment Form Letter Template Word Letter Form

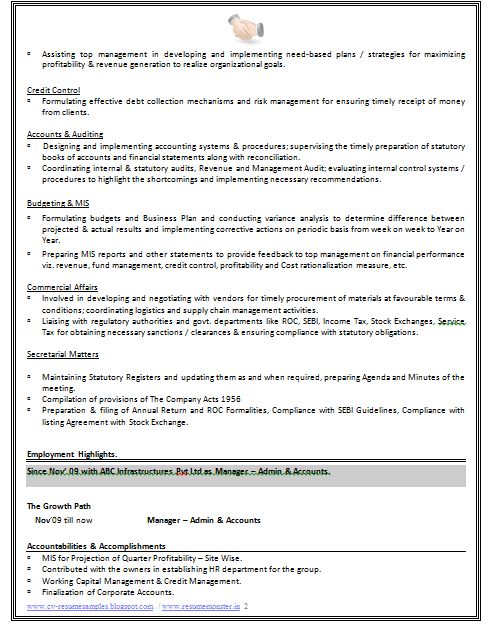

Chartered Accountant Resume Format Freshers Page 2 Accountant Resume Resume Format Resume Format Examples